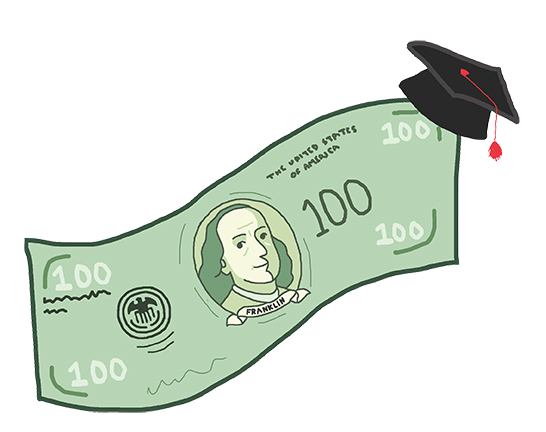

The Price of College Debt

The weight of college debt is no longer just physical; now it’s taking a mental toll on young people, impacting their mental health, focus and sleep. With cumulative debt increasing steadily with each passing year, one must question: How can teenagers prepare for their future while simultaneously being told that they might not get one?

December 3, 2019

Children grow up being told the same thing over and over: do well in school, get a job, make money and start a family. The cycle repeats. However, this cycle is not only unreasonable but, for many, unattainable.

In 2006, 13 years ago, student debt nationally was under 600 billion dollars — which seems big but, in relation to population and graduate rates, was slightly more reasonable.

Today, collective student debt totals over $1.5 trillion dollars, which is a 150 percent increase. This is an insurmountable number, one that accurately depicts how flawed the current loan system is.

Since the mid-2000s, when the recession—or economic depression—hit, funding for public four-year colleges has decreased by nearly $10 billion dollars.

As states slash the funding for college tuition, schooling is becoming less accessible for students who rely on the lesser prices that accompany public education.

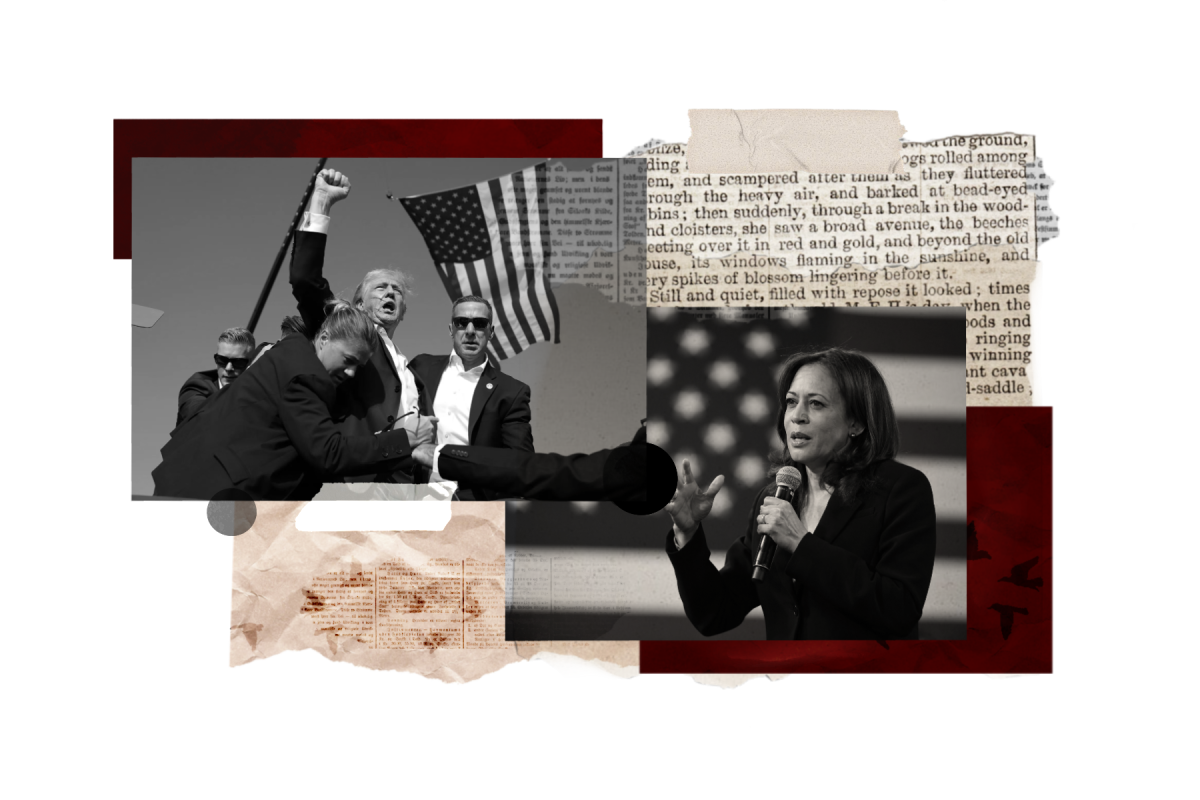

Comedian Hasan Minaj, a recent addition to Time’s “100 Most Influential list,” dedicated an episode of his comedy news show to the topic of college debt. In his weekly show “Patriot Act,” Minaj addresses worldly topics like the Indian elections, affirmative action, Supreme, and, in this case, student loans. He went as far as to poll his small studio audience, mainly made up of post-grads. Between them, there was over six million dollars of debt.

Minaj pointed out the fundamental flaws in the education system, claiming that now, more than ever, there is no space for error: “You can’t make any mistakes. Otherwise, you might face some of the most aggressive debt collection practices.”

He played a clip depicting the suspension of medical licenses of practicing doctors who had remaining loans to pay.

Some may argue that there is a basic lack of logic in taking away a person’s source of income in an attempt to collect loans that can’t be paid off without a reliable salary. The clip Minaj played showed a man arrested by the federal marshal’s office — for $1,500 dollars of loans.

Student loans impair the way teens plan for their future. From childhood, money is taught to be precious, unreliable, coveted. Minaj stated that “Growing up, it was drilled into our heads: you’ve got to go to college if you want a middle-class job.”

We were told that without a middle-class job, there was no way to have the ideal future.

Need of an education to get a job leads teens to choose to attend a trade school rather than attend a school for what they are passionate about.

For teens, not only does fear impact choices about their future, it also affects their mental health when considering the possibility of future debt.

Some students have started actively saving for college when they are still underclassmen in high school. The impending threat of student loans not only influences how they live their lives but also how they plan for their futures and decide plans for education.

CNBC looked into the mental-health impact that this hot-topic issue has on teens. Through a Student Loan Hero survey, over 60 percent of teens surveyed admitted to a “fear [that] their student loan debts… [will] spiral out of control.”

And that’s just looking at young teens, many of whom don’t even have debt yet. It’s not just mental, either. Psychological stress affects teens’ wellbeing. The same survey found that students are “suffering from headaches or lack of sleep from the sheer stress of it.”

That’s terrifying when one thinks about it that students who have not yet graduated from high school are already suffering a physical and mental toll on their body from constant stress and fear.

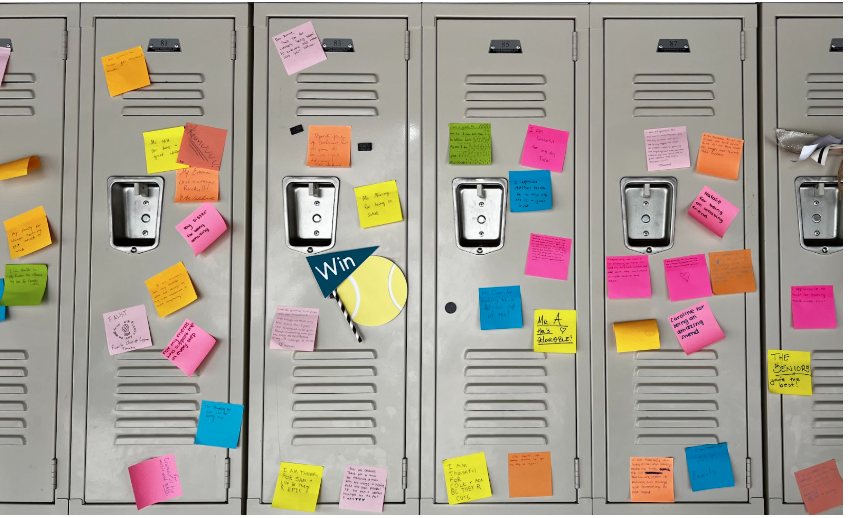

Laguna seniors, teens preparing to enter the world of college and the possible burden of debt, were passionate when questioned about the impact that these pressures had on their psyche. Said one senior who chose to remain anonymous, “It’s like I’m being choked. Constantly.”

The world of college loans and debt is fundamentally flawed if this is the impact that the fear of loans has on students.

The senior went on to talk about the perpetual feeling of helplessness that accompanies the debt crisis, saying: “I can’t breathe.”

Another senior, Charlie Jacobs, recognized the unavoidable pressure but took an optimistic view of it. Identifying the issue, but understanding its probable impact in his life, Charlie said, “[College Debt] is going to be

Inevitable, so part of me is worried about it, but I know that no matter what I will still be in some kind of debt.”

However, he didn’t end on a negative note, “I don’t want that to hold me back.”

It’s important to remember: it should be about finding the school that works best for you, not just about creating a college plan that will leave you financially stable.

Of course, taking into consideration statistics and the increase in debt nationally, financial stress is almost inescapable.

If they think like Charlie, however, students may realize how many opportunities there are for students— without letting anxiety overwhelm them.