Facing a $68 billion dollar budget deficit, California, the world’s 5th largest economy, is struggling with the effects of inflation and high interest rates, constituting a budget crisis at the state level. Spending over $300 billion a year, California’s budget is not only the largest in the United States, but would compete with many of the world’s nations.

According to Investopedia, a local, state, or federal budget deficit occurs when government spending outpaces the revenue or income it collects from taxes, fees, and investments, constituting the government as a public entity that follows the same regulations and obligations in paying off debt.

Nevertheless, this issue is in stark contrast to California’s economic situation during the COVID-19 pandemic just a few years ago, especially amid rising political tensions and concerns regarding Governor Gavin Newsom. Even amidst a global recession, the state had a $47 billion and $55 billion dollar surplus in the fiscal years 21-22 and 22-23.

But, with the pandemic now over and other external factors coming into play, California has had to adjust, especially with Governor Newsom’s national prominence. In the middle of high-profile political debates, interviews with the biggest names in the news on national television, and seen as a rising star in the democratic party, Governor Newsom is building a national resumé in his second term as governor.

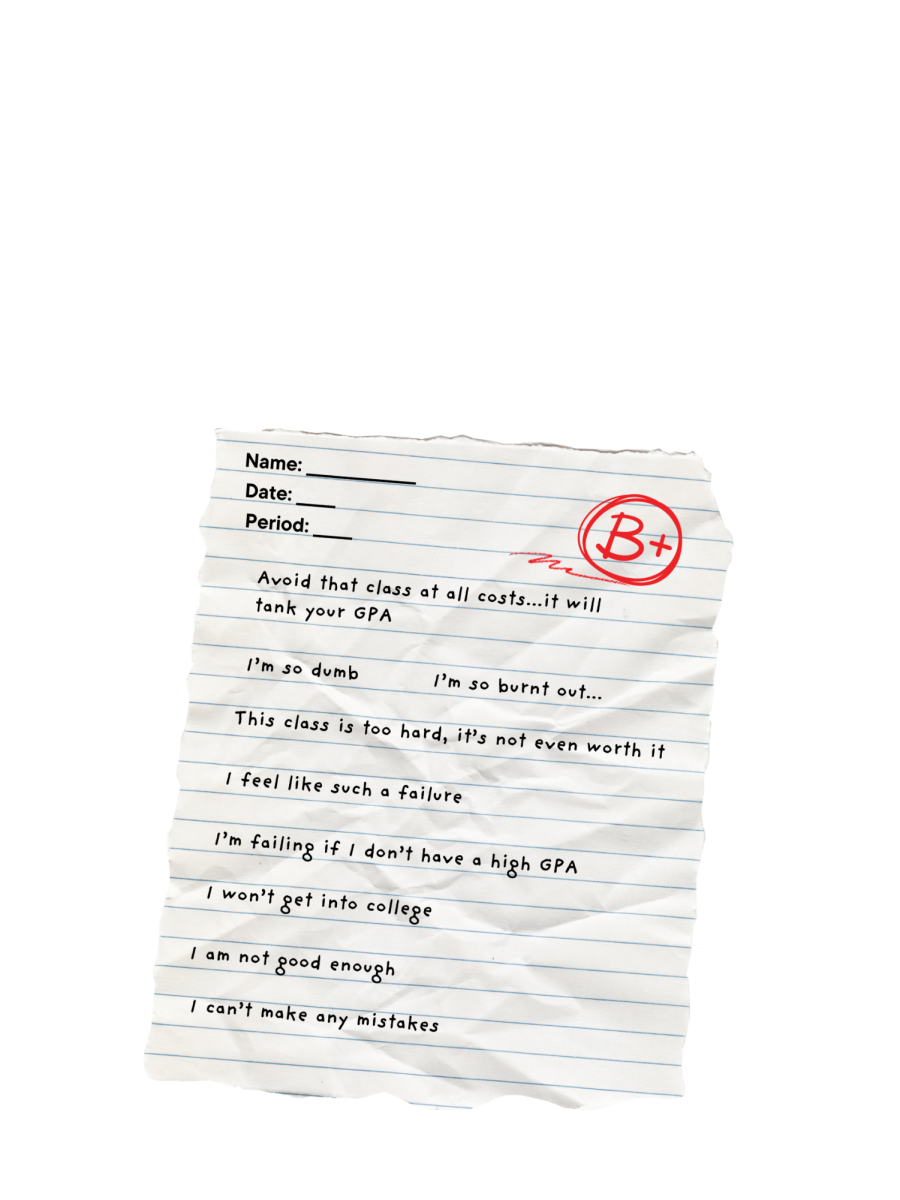

“Governor Newsom has certainly done a great job in building his national profile, even amongst scandals,” AP Economics student Rio Valle said. “However, an exponential increase in social spending and money provided to the state’s school system are now starting to hurt Californians..”

Referencing Newsom’s decision to delay tax payments from 2022 until November of 2023, the state legislature, in conjunction with Newsom, was forced to create a budget without having an exact figure as to how much money the state should spend. According to the nonpartisan Legislative Analyst Office (LAO), tax collections were off by $26 billion, one of the major drivers of the deficit.

Despite the multi-faceted nature of this issue, partisan debates and arguments are emerging as Republicans drastically oppose Newsom’s measures to raise wages for government employees and minimum wage workers across the food and agricultural sectors.

“Republicans cautioned that this level of spending would lead to greater deficits, and it would be more prudent to show restraint. Unfortunately, the majority party ignored those warnings,” said state Sen. Roger Niello, the vice chair of a bipartisan committee that oversees the state’s budget.

In addition, an analysis by the LAO also concluded that California’s economic success is in direct correlation with the actions of the Federal Reserve, meaning that national policy has major implications even in the world’s 5th largest economy.

according to many legislative analysts and Californians, this is certainly a multi-faceted issue.

“Even though the California legislature continues to cut down on spending for K-12 public schools and money provided to the UC and CSU systems, the covered operating cost for those schools is around $127 billion dollars, more than 1/3rd of the state budget,” said Rio. “Also, it’s going to take a lot of money to cover the rising costs of healthcare programs, and other consequential tax decisions will continue to implicate the governor in what might really become a scandalous situation.”

Newsom’s first term in office was supported by a more than $100 billion dollar surplus, allowing for the expansion of the state government’s reach as universal healthcare was introduced. The LAO also now projects a cumulative $155 billion deficit by the end of 2028.

With this continuous loss in revenue, Taryn Luna of the LA Times reported that the state made major cutbacks to some of Governor Newsom’s campaign promises in the summer.

“Gov. Gavin Newsom and Democratic legislative leaders on Monday agreed to a $310.8-billion spending plan that will reduce investments in fighting climate change and reflects a compromise on the governor’s last-minute proposal to speed up infrastructure projects across California,” Taryn said.

Regardless, California’s fight against climate change continues with over one-sixth of the state’s budget dedicated towards climate initiatives.

“Such a multi-faceted issue not only requires many perspectives but also requires lawmakers in Sacramento to be more fiscally responsible, especially with more and more problems arising with each passing day,” Carson Stewart said. “Irrespective of my own opinion, it’s not a great sign that the state is facing a deficit with the enormously high tax revenue that it collects each year.”

An increase in tax rates and prices has led to a jump in mortgage payments and fewer home purchases according to Oscar Wei, the deputy chief economist for the California Association of Realtors.

Legislative analyst Gabriel Patek believes that the state still remains in a good cash position, so we should “stop short of calling it a crisis.”

In terms of national metrics, the unemployment rate has steadily remained around 4%, around 2% lower than the national unemployment rate when California actually held a budget surplus of $55 billion.

“The state is still in a favorable infrastructure position, and continues to enact numerous climate initiatives,” Rio said. “Slight adjustments to the budget should be enough to get the state back on track.”